Table of Contents

- Filial Singer - VGT TV

- (a) is the comparison of different versions of VGT. "EN" represents the ...

- VGT 🟥 - YouTube

- VGT ETF: Promising Long-Term Outlook With Short-Term Uncertainty ...

- VGT 🟥 - YouTube

- The different phases of VGT ® . | Download Scientific Diagram

- Teori dan Cara kerja VGT (Variable Geometry Turbocharger) - mautaumobil.com

- Vgt logo design Stock Vector Images - Alamy

- 투싼VGT 가속불량 차량 투싼VGT ROM이상 수리! : 네이버 블로그

- Ferrari VGT in GT7 - gtplus

What is Vanguard Information Technology ETF (VGT)?

Current Price of VGT

Performance and Holdings

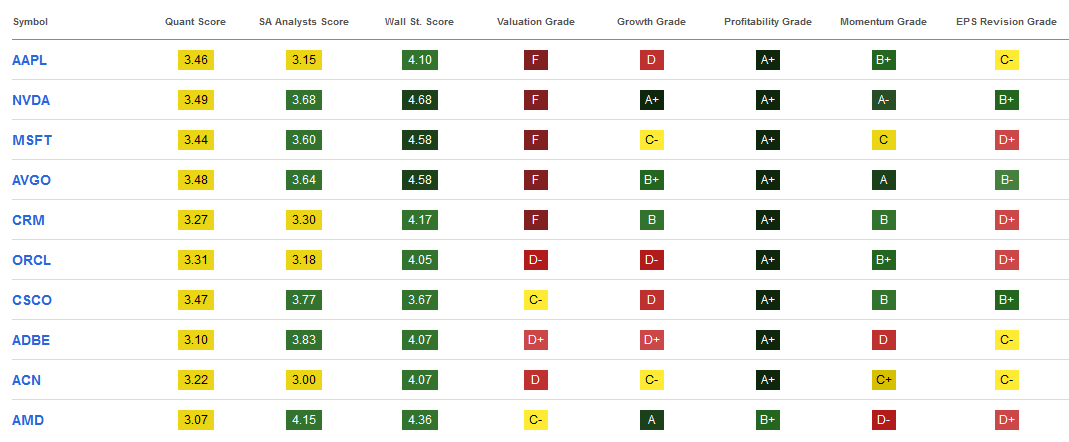

VGT has consistently demonstrated strong performance, with a 1-year return of over 40% and a 5-year return of over 23%. The ETF has a diverse portfolio of over 360 holdings, with top holdings including tech giants like Apple, Microsoft, and Alphabet (Google). The fund's expense ratio is a low 0.10%, making it an attractive option for cost-conscious investors.

Benefits of Investing in VGT

Investing in VGT offers several benefits, including: Diversification: By investing in a broad range of tech companies, you can spread risk and potentially increase returns. Convenience: VGT provides a single investment solution for those looking to tap into the tech sector, eliminating the need to select individual stocks. Low Costs: The fund's low expense ratio helps keep costs down, allowing you to keep more of your investment returns. Professional Management: VGT is managed by Vanguard, a reputable and experienced investment management company. The Vanguard Information Technology ETF (VGT) is a compelling option for investors looking to capitalize on the growth potential of the tech sector. With its diverse portfolio, low costs, and strong performance, VGT is an attractive addition to any investment portfolio. As with any investment, it's essential to do your research, consider your risk tolerance, and consult with a financial advisor before making a decision. By staying informed and up-to-date on the current price and performance of VGT, you can make informed investment decisions and potentially unlock the potential of tech investments.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making investment decisions.