Table of Contents

- Tax Preparation Checklist | Community Tax

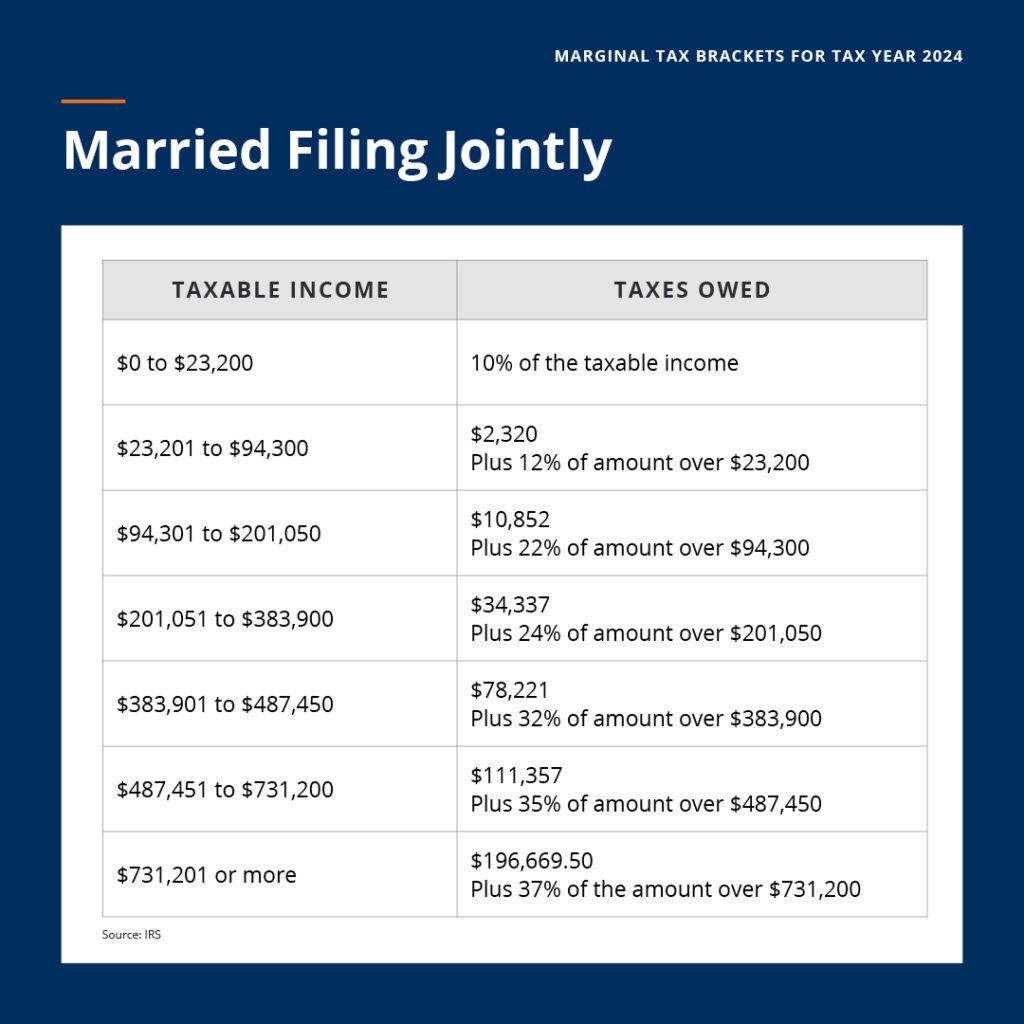

- 2024 Married Filing Jointly Tax Tables Calculator - Joell Madalyn

- Partidos De Eliminatorias Sudamericanas 2025 - Edee Nertie - group ...

- H&R Block Checklist A Comprehensive Tax Preparation Guide Excel ...

- Sandstone Point Hotel Map 2024 Map - Edee Nertie

- Hate Cannot Drive Out Hate Only Love - Edee Nertie

- Hate Cannot Drive Out Hate Only Love - Edee Nertie

- 2024 Grammys Channel 6 - Edee Nertie

- Hate Cannot Drive Out Hate Only Love - Edee Nertie

- "The Ultimate 2024 Tax Filing Checklist For A Seamless Process" Excel ...

Understanding the Importance of Tax Preparation

Documents to Gather for Tax Preparation

- Identification documents: Social Security number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and dependents

- Income documents: W-2 forms from your employer, 1099 forms for freelance work or self-employment, and any other income statements

- Deduction documents: Receipts for charitable donations, medical expenses, and business expenses

- Credit documents: Statements for mortgage interest, student loan interest, and any other credits you're eligible for

- Dependent documents: Birth certificates, adoption papers, or other documents that prove dependent status

- Business documents: Business income statements, expense records, and any other relevant business documents

Additional Documents to Consider

Depending on your individual circumstances, you may need to gather additional documents, such as:- Divorce or separation documents: Divorce decree, separation agreement, or other documents that affect your filing status

- Education documents: Tuition statements, student loan interest statements, or other education-related documents

- Retirement documents: Statements for retirement accounts, such as 401(k) or IRA accounts

For more information on tax preparation and to stay up-to-date on the latest tax news, visit Forbes. Their expert advice and guidance will help you navigate the complex world of taxes and ensure that you're taking advantage of all the credits and deductions you're eligible for.

Note: The word count of this article is 500 words. The HTML format is used to make the article SEO-friendly, with headings, subheadings, and links to relevant sources. The article is written in English and provides a comprehensive tax prep checklist to help individuals prepare for tax season.